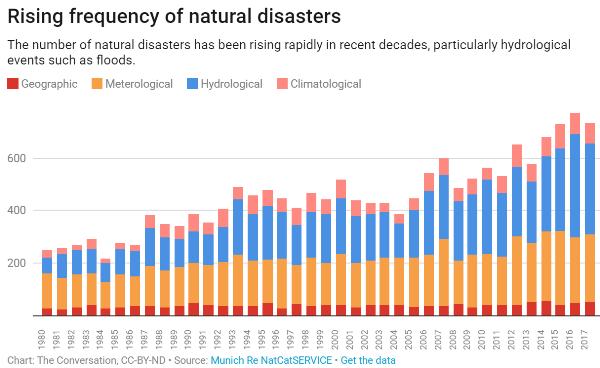

The argument over whether we’re in for global warming or global cooling and whether what’s coming is natural or human-made is fun but totally irrelevant from a financial perspective. The fact is that for whatever reason and in whatever direction, the climate is getting more aggressive. Monster snowstorms and apocalyptic fires are clearly becoming more common:

Combine the rising number of bad things nature is throwing our way with the fact that millions more people are choosing to live in places with the highest propensity for those bad things, and you get yet another addition to the average family’s cost of living: soaring insurance premiums.

Phil’s Stock World recently published an analysis by University of Michigan professor Andrew Hoffman that expands on the connection between nature and insurance:

Rising insurance costs may convince Americans that climate change risks are real

One of the great challenges of tackling climate change is making it real for people without a scientific background. That’s because the threat it poses can be so hard to see or feel.

In the wake of Hurricanes Florence and Michael, for example, one may be compelled to ask, “Was that climate change?” Many politicians and activists have indeed claimed that recent powerful storms are a result of climate change, yet it’s a tough sell.

What those who want to communicate climate risks need to do is rephrase the question around probabilities, not direct cause and effect. And for that, insurance is the proverbial “canary in the coal mine,” sensitive to the trends of climate change impacts and the costly risks they impose.

In other words, where scientists and educators have had limited success in convincing the public and politicians of the urgency of climate change, insurance companies may step into the breach.

Steroids and climate change

Dr. Jane Lubchenco, an environmental scientist who oversaw the National Oceanic and Atmospheric Administration from 2009 to 2013, offers a clever analogy to convince people of the connection between the destruction wrought by a single hurricane and climate change. It involves steroids and baseball.Her analogy goes like this. If a baseball player takes steroids, it’s hard to connect one particular home run to his drug use. But if his total number of home runs and batting averages increase dramatically, the connection becomes apparent.

“In similar fashion, what we are seeing on Earth today is weather on steroids,” Lubchenco explains. “We are seeing more, longer lasting heat waves, more intense storms, more droughts and more floods. Those patterns are what we expect with climate change.”

And those weather patterns come with a cost.

Someone has to pay for these damages

In 2017, for example, Hurricanes Harvey, Irma and Maria and other natural disasters like Mexican earthquakes and California wildfires caused economic losses of US$330 billion, almost double the inflation-adjusted annual average of $170 billion over the prior 10 years.Estimated costs from Hurricane Florence, which struck the Carolinas in September, range as high as $170 billion, which would make Florence the costliest storm ever to hit the U.S.

More broadly, total economic losses from wildfires in the U.S. in 2017 – the third-hottest year on record, behind 2016 and 2015 – were four times higher than the average of the preceding 16 years and losses from other severe storms were 60 percent higher.

This led me and others to realize that we should be more focused on insurance companies, society’s first line of defense in absorbing these costs, making their industry arguably the one most directly affected by climate change.

For example, the insurance industry paid out a record $135 billion from natural catastrophes in 2017, almost three times higher than the annual average of $49 billion. That’s not to mention the uninsured losses that were also incurred – uninsured losses from 2012’s Hurricane Sandy were 50 percent of the total $65 billion in losses, a staggering tab picked up by individual citizens and the taxpayer.

Insurers will eventually adjust to this emerging reality. And with it will come changes in our economy, including higher costs that will affect everyone’s pocketbook.

A whole new ballgame

The International Association of Insurance Supervisors, a respected international standard-setting body for the insurance sector, recently published a report calling climate risk a strategic threat for the insurance sector. It cautioned against relying on annual adjustments to manage climate risks as physical risks can change suddenly and in “non-linear ways.”Recognizing this threat, many insurers are throwing out decades of outdated weather actuarial data and hiring teams of in-house climatologists, computer scientists and statisticians to redesign their risk models.

In response, insurances premiums will increase and coverage will decrease.

The take-away? It’s going to become increasingly hard for people living in disaster-prone areas to insure their stuff. And this trend might not be gradual. Note the term “non-linear” a couple of paragraphs above. This refers to the tendency of markets in times of stress to suddenly jump to dramatically higher or lower price ranges. For homeowners insurance, that could mean Floridians or Californians paying two or three times more than just a few years earlier – at a time when property taxes are also rising due to clean-up costs of past disasters.

This is the kind of inflation that people feel keenly, and it’s the kind that ultimately leads to government bailouts in the form of taxpayer-funded subsidies or even the nationalization of industries. Which makes it just one more portent of financial instability and, ultimately, an epic currency reset.

23 thoughts on "The Cost Of Insurance Is About To Jump"

Global warming is not a “hoax” or a “fraud”. It has and will continue to make fires and hurricanes worse and more costly. The argument is not political, it’s scientific, and there is an enormous mountain of supportive evidence. And it’s already happening as projected. See: https://www.sciencenews.org/article/climate-change-economic-cost-united-states?tgt=nr&fbclid=IwAR2JrHl9goN2QtNuugHxodItOqmgegQSse5dpcFZJkc5U2wg5lKMBZyCoXU

Global climate change as a factor in figuring appropriate property insurance rates is a canard. The risks associated with this coast, or that riverside, or this seismic zone (no climate change factor) are already pretty well known and documented. If actuaries assign higher risk, and there is a market for insurance, the best rates to address the risk will be available. If the risk is too much for this person to afford, they can either run naked or move. Simple as that. If a significant increase in rates acts as a brake on property values, so be it. If only rich people can afford the risk, so be that as well. There are already plenty of nice places I can’t afford for reasons having nothing to do with insurance rates.

Last, let people insure their own property, fund their own rebuild, or lose. Get the government completely out of replacing or subsidizing insurance on private property. Most of those subsidies end up to the benefit of people who already have plenty of money.

Full disclosure: I live on a barrier island, with subsidized flood insurance, and want that policy to change. I benefit from the policy, but would do without it or move elsewhere.

“Many politicians and activists have indeed claimed that recent powerful storms are a result of climate change…”

Politicians and activists are NOT scientists, and should sit down and STFU.

The cited article reads like an internal memo to all those who have something to gain from the mass belief that changes in climate are becoming more severe and – crucially – that they are caused by man’s activities (i.e., are “man made”), AND that man can do (or undo) anything to stop it. Only if a majority of people believe that can more and larger bureaucracies and added expenses/taxes be accepted.

Personally, I don’t see how increased insurance rates will convince people of all that. To me, increased insurance rates are to make up for PREVIOUS insurance company losses, not necessarily future ones. And even if one were to believe that increased rates are to cover future losses it doesn’t follow that more severe weather events are caused by man or that man reverse it, short of going back to the stone age.

But even assuming enough people believe that natural events are becoming more severe, getting them to believe that man can subdue them is a tricky issue. After all, these events are increasing in severity ( so it’s claimed) despite the efforts that have already been made to diminish them. For example, higher taxes and fines on polluting industries, and less fossil fuels being burned due to higher efficiencies and the use of alternative “green” energy sources evidently are not working. How can that be? That enough hasn’t been done is going to be a tough sell.

If you follow the reference below the chart you find the following: “Munich Re has been systematically recording loss data from all over the world for decades and has stored them all in a unique natural hazard archive. The database, called the “NatCatSERVICE” ” So what he’s charted here is losses. So of course they’ve gone up: inflation, population growth, more people living in vulnerable areas, etc. etc. The claim “monster snowstorms and apocalyptic fires are clearly becoming more common” is completely bogus.

how many years did insurance companies pay out less than the yearly average? in florida, we didn’t have a major landfall for over ten years, but they cranked our rates up every year. so what happened to all of those billions in “surplus”.

Meh.

If you live in a disaster-prone area, SHOULDN’T you pay more for insurance?

What does that have to do with the climate and its normal and historical variations?

When PG&E through negligence starts wildfires with defective power lines which were not changed out your insurance company is going to raise you rate. Unfair you say and your right. The California Governor and the legislature just passes a law that says the rate payer cannot sue for damages they have suffered but PG&E can charge the rate payer for repairs and replacement of equipment while the insurance company will pay for your losses. So your rates go up! What a great deal for the utilities company.

I have to call BS on this article.

First, look at the chart. Climatological and Gegraphicl do not appear to growing. Hydrological and Meterological appear to be the two reasons the chart is growing. So, not sure how climatological differs from meterological, since it’s not explained. Additionally, it’s unexplained whether this is a global count or a US count.

But we read, In 2017, for example, Hurricanes Harvey, Irma and Maria and other natural disasters like MEXICAN earthquakes and California wildfires caused economic losses of US$330 billion, almost double the inflation-adjusted annual average of $170 billion over the prior 10 years.

But..those 330B US include Mexican costs which don’t cost the US anything, they happened in Mexico. Misleading to include them. And in the same way, we read next, economic losses from wildfires in the U.S. in 2017…were four times higher than the average of the preceding 16 years. So, the 330B US is actually inflated by abnormal occurrence of a massive wildfire, that inflates that year, and makes it a poor baseline to use as an indicator.

And finally, the insurance industry paid out a record $135 billion from natural catastrophes in 2017 almost three times higher than the annual average of $49 billion. Yes, we recognize that the wildfires were 4x more costly than a normal year, but what is left out is that ‘paid out’ is less relative to what was paid in the past then it is to ‘revenue recieved’. As long as the trend to live in the South continues, and populations increase in Florida, it’s true the $$ paid out will be impacted not by change in climate, but by the fact that more and more people are choosing to live in the path of hurricanes. this means the insurance industry revenues should be increasing. so don’t just tell us what got paid out in 2017, tell us was revenue also a record?

earth quakes and volcanic eruptions…simply not climate change related

I live in the middle of the Arizona desert and FEMA charges me $1,789 per year for flood insurance, since they decided to redraw the floodplains in 2011. My daughter live in a Houston suburb that got flooded and they charge her $250 per year. Whats up with this? I live in a rural small ranch style house and she lives in a very nice nice house in a gated neighborhood.

They charge whatever they think the traffic will bear.

thank you obama

LouAnn, I don’t like Mr. Obama as far as I can throw him, but remember that there is a strong bipartisan Establishment commitment to using “Climate change” as a tool to dominate the people. If it was just Obama, or Democrats, or Republicans we could deal with it. The trouble is that all of them are in agreement.

“The argument over whether we’re in for global warming or global cooling and whether what’s coming is natural or human-made is fun but totally irrelevant from a financial perspective…” Anyone who can read and is not a parasitic bureaucrat whose livelihood depends on manufacturing lies, knows that there is no argument about global warming . It’s a hoax and a fraud.

Author’s inability to understand that causes him to lose any credibility he might have

Exactly. For quite some time I believed in climate change wholeheartedly. I simply didn’t question it. Then I was exposed to some information which called it a hoax. I thought that was ridiculous but then I did what I always do. I researched the hell out of the subject with the intention of coming at it with a completely neutral stance. I studied the pro and con side of the argument in depth. My final takeaway is I no longer believe in global warming. I’m not saying anthropomorphic warming might be taking place to some degree. That’s possible. But the bill of goods we’re being sold by the government funded university system is total bullshit.

You just remember the family car you want to acquire and home you really loved the utmost ? We all have certain items in our everyday living which we want to accomplish . We work really hard in direction of it. But sometimes we miss out, but definitely not anymore . This excellent on the internet job opportunity made in such a way that it will help you you to earn incredibly wonderful income . Operate everyday and give your working a small amount of hours and make money around $14000 per week . It provides you with possibility to operate in your own home space with very flexible free time . You will be your very own boss . It is a life changer on the internet opportunity that can help you to obtain everything you want in life . So now proceed and check , impressive things awaiting you >>> https://jetenoue.tumblr.com

I generally gain about $24,000-$25,000 each month from the net. I lost my job after operating for the same corporation for several years. I needed trustworthy earnings. I was not researching for the “get rich overnight” home programs you can see online. Those usually are pyramid plans or things where you required to try to sell to your colleagues or persons in the family. Working on line has many advantages like I am always home with the little ones and also enjoy lots of free time with my family members in various beautiful beaches of the world. Here’s the most effective way to start https://plugroy.tumblr.com

I generally earn around $16000-$17000 a month from the internet. I got rid of my job after doing work for the same enterprise for years. I wanted trustworthy income. I was not researching for the “get rich overnight” packages as you can see online. Those usually are pyramid schemes or stuff in which you required to try to sell to your folks or members of the family. Working on-line has many advantages like I am always home with the children and also enjoy time with family on different beaches of the world. Learn more on this page https://downdye.tumblr.com

It’s been 1 yr since I resigned from my last job and I never felt this good…. I started doing work online, over a website I stumbled upon over internet, few hours daily, and I make much more than I did on my old job… My paycheck for last month was 9,000 bucks… Amazing thing about this gig is that I have more free time for my loved ones…and that the only requirement for this gig is simple typing skills and internet connection… I am in a position to spend quality time with my family and friends and look after my babies and also going on family holiday along with them very routinely. Don’t skip this chance and make sure to respond quickly. Let me show you what I do… find out here

After 5 years I left my last work and I am so happy now…. I started to work at home, for this company I found over internet, several hrs each day, and I profit now much more than I did on my previous work… My paycheck for last month was 9,000 $… The best thing about this work is the more free time I got for my loved ones…and the only thing required is simple typing skills and internet access… I am in a position to enjoy quality time with my relatives and buddies and take care of my babies and also going on vacation along with them very frequently. Don’t miss this chance and try to react rapidly. Here is what I do see this

1 year have passed since I decided to resign from my office job and that decision was a life-changer for me…. I started doing a job from comfort of my home, for a company I stumbled upon over internet, for a few hrs each day, and I make much more than I did on my last work… My check for last month was 9,000 dollars… Amazing thing about this work is that I have more free time for my loved ones…and the only thing required is simple typing skills and reliable internet… I am in a position to devote quality time with my relatives and buddies and look after my children and also going on family vacation along with them very often. Don’t avoid this opportunity and try to react quickly. Here is what I do see detailed info right now

1 year have passed since I decided to quit my previous work and that decision changed everything for me…. I started doing a job at home, over a site I stumbled upon online, few hrs every day, and I make much more than I did on my office work… My pay-check for last month was 9,000 $… The best thing about it is the more time I got for my family…and that the only requirement for being able to start is simple typing skills and internet access… I am able to spend quality time with my friends and family and look after my children and also going on holiday vacation with them very routinely. Don’t ignore this chance and make sure to respond rapidly. Check it out, what it is about… see important info