A central bank that’s desperately trying to ignite a borrowing/spending frenzy to offset an incipient recession has one wish above all: That the currency it’s creating flows beyond safe-haven assets and into riskier niches. Call it the democratization of credit or Ponzi finance. Either way, the result is a lot of borrowing and spending, which solves the immediate slow-growth problem.

So it must come as a pleasant surprise for monetary authorities that a growing number of “high-yield” bonds are trading with negative yields. You read that right: some junk bonds now yield less than nothing.

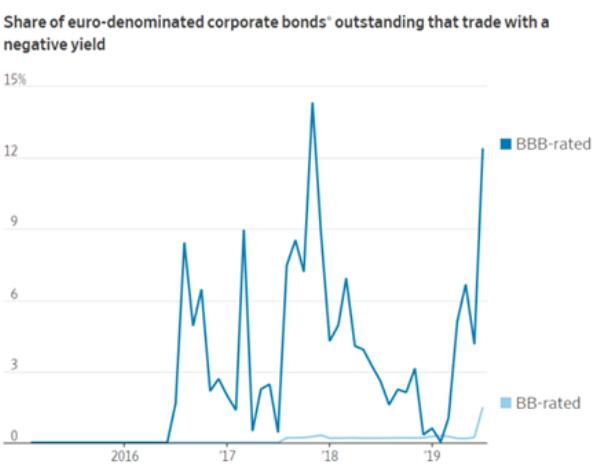

So far, this is happening mainly happening in Europe, where the ECB has been soaking up the bonds of junk countries like Italy, producing Italian government bond yields comparable to those of the US and not far from Germany’s. Now some of this torrent of newly-created euros is flowing into the corporate equivalent of Italy, sending the share of one-step-above-junk BBB rated bonds with negative yields to double-digits. Meanwhile, the share of actual junk bonds with negative yields is above zero and rising fast.

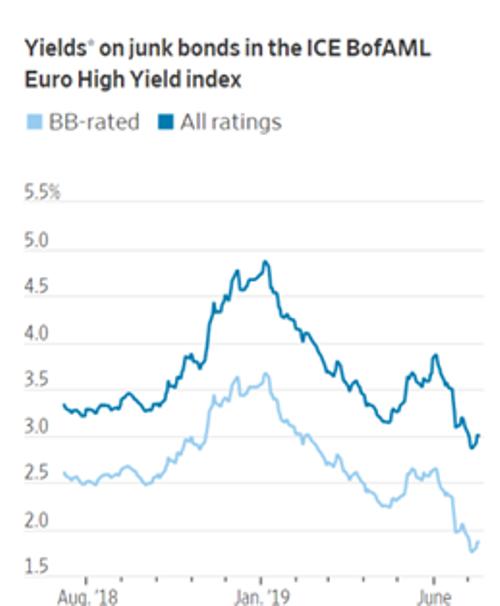

For the entire universe of European BB-rated bonds (to repeat, these are junk), the average yield is now comparable to what the US pays on 10-year Treasury bonds.

So why is this happening, and is it as bad as it seems?

The short version of “why” is that when a country borrows too much money, its rising debt slows future growth unacceptably, leading politicians to bully central banks into cutting interest rates further and buying up more assets. Eventually, this process reaches its logical conclusion, which is zero-to-negative interest rates and central bank balance sheets stuffed with assets of laughably low quality. Which is where Europe now finds itself.

And still, the politicians demand more. So rates go negative across the high-quality yield curve (German 10-year paper now yields -.30%), forcing everyone who needs income to move into junkier assets. And voila, high-yield starts trading like Treasuries.

As for why that’s bad, well, let’s count the ways. First, it funnels cheap capital into companies that by definition don’t deserve it, which results in “malinvestment” on a vast scale. Second, it starves pension funds and retirees that need income, forcing them to take on ever-higher degrees of risk. Combine massive misallocation of capital with excessive risk-taking by investors who don’t understand risk, and the result is an epic crash when junk borrower cash flows inevitably disappoint.

Why do investors put up with it? Saturday’s Wall Street Journal offers a chilling explanation:

One euro junk bond from U.S. packaging company Ball Corp, for example, trades at a yield of minus 0.2% and matures in December 2020. That compares to a European deposit rate of minus 0.4% or a yield on a German government bond with a similar maturity of about minus 0.7%.

The choice for investors is about the balance between needing to stay invested and how much risk to take, according to Tim Winstone, a fixed-income portfolio manager at Janus Henderson. A bond like Ball Corp’s is “a safe place to hang out,” Mr. Winstone said. “And just because something is negative-yielding, that doesn’t mean it can’t get more negative-yielding.” Falling yields mean rising bond prices and gains for investors, at least on paper.

Many expect more bond yields to go negative as central banks in the U.S. and Europe cut interest rates or return to bond-buying to stimulate economies. In Europe especially, investors are realizing that negative interest rates are going to last a long time because the ECB needs to overshoot its inflation target to make up for the long spell when inflation has been far below 2%. Without a period of higher inflation, it won’t meet its target on average over the medium term.

The number of junk-rated companies with negative-yielding bonds will definitely go up, according to Barnaby Martin, credit strategist at Bank of America Merrill Lynch. “It doesn’t take much for it to go from 14 companies to 30 or 50 or 100,” he said.

In other words, investors are now extrapolating falling interest rates into the future and playing junk bonds for the capital gains they’ll generate when their future borrowing costs go down. This is one of those sentiment shifts that financial historians will single out for special attention when sifting through the rubble of the coming crash.

12 thoughts on "Now That’s Just Crazy, Part 1: Junk Bonds With Negative Yields"

It is rather the opposite. The more trusted a currency is, the lower the interest rates. The euro is more trusted than the US dollar because of the stability and growth pact. The Swiss franc has even lower rates.

The article doesn’t metion that Germany has a budget surplus. Italy, the problem country, has only a 2% deficit. The US has a deficit of 4% and a smaller tax base (meaning an equal deficit in the US is less sustainable than in Italy).

That’s why investors are gobbling up euros, even at negative rates. Must be, because Argeninian bonds offer far higher rates.

As soon as the US fixes its budget problems, the economy will slow down and interest rates will crater. -1% will not be enough so the existence of cash is a problem.

After several yrs I decided to get away from my previous occupation and it totally changed my everyday life… I began doing a task via internet, for a corporation I found out on internet, for a number of hrs in a day, and I make money definitely more than I managed to do on my previous occupation… Very last pay-check I obtained was 9 thousand bucks… Superb point about this is the fact I get additional time for my family. Examine it, what it is about… manhandletamarin.seite.com

Doing an occupation to help you to really cherish your life, It is always what you should look for. Travelling together with work from all around the world from Italy, Rome, Berlin to Paris. Quite simple Internet job, just simply get your laptop and you are ready to earn. I have been able to earn 72 Dollars simply just doing work for couple minutes. Pressure free work from the most reliable and awesome internet websites. Don’t skip and try this out —> bpl.kr/6iC

I ordinarily acquire close to 6,000-8,000 US dollars almost every 1 month via internet. Haven’t you understood that the future is in the online arena whether is online marketing or simply working for businesses which are based and hire online employees. If you do not do it today you will always regret it because sooner or later you’ll be force to make the change however, you won’t be in the driver’s seat any longer. So what are the advantages to having the ability to generate money online? Well there are a few. For one there is increased ability to automate and therefore be functioning while, you are sleeping. You also don’t have to work in the uncomfortable and typical work environment. You can work when you need and this comprises more flexibility to take that needed vacation whenever. You can work where you want–at home, in the library, at the coffee shop, in your cabin, or in your Caribbean cruise. Other enormous advantages to a”earn money online” type of job are you don’t have to think about product whether is be storage, supply, tech assistance, you name it. So this sounds great ? What exactly are you waiting for? Oh. . .you think that the initial risk of quitting the job to make money online is too large? Well then do not quit your job! You are able to easily keep both a standard job and an internet income at the same time and you will discover very soon that you don’t have anything to fear. So please don’t wait, now is your chance to beat the mad rush and in the speed that makes you comfortable. —-> fl-y.com/10ky4

You can easily abandon your low paying 9 to 5 job and start off earning paychecks each month approx 12 k dollars working at home. Let’s be real, no matter where you’re working from, you’re still doing simply that: working. While working from home you have Extremely flexible daily schedule – you can take breaks at any hour, feel absolutely no rush to hang up on your loved ones when they call, and consume meal at any unusual time you choose, Forget about crowds or heavy traffic – Absolutely no stuffing yourself into a rickety transportation tube, having people scuff your brand-new shoes, or walking behind agonizingly slow people who apparently don’t know what a straight line is, Much more time with loved ones -Take good care of a sick significant other at your house, get ready for your kids earlier in the day time, get some extra snuggles in with your doggo, or simply have some relaxing time to yourself! Try it out, what it’s about… earn20kpermonth.am-geilsten.de

You try to remember the family car you want to purchase along with own home you loved the a lot ? All of us have certain items in our life which we would like to fulfill . We do a lot of work in the direction of it. Even so usually we miss out, but not any more . This excellent on line venture created in a manner that it will help you to make remarkably very good income . Do the job per day and give your tasks small amount of hours and receive around $37000 weekly . It provides you opportunity to work in your own house place with very flexible free time . You are going to be your own boss . It is actually a life changer on the internet job that can help you obtain whatever you want in your lifetime . So now go and check , great things waiting around for you >>> ya.mba/2Uw

Earn extra income weekly… It’s an awesome side work for anyone… The best part is that you can work from comfort of your home and earn between 100-2000 bucks each week … Start now and have your first paycheck by the end of the week…> writer.cs-clan.org

Obviously they know that when the dollar collapses as world usage and is devalue by some say at least 50% these bonds will seem a bargain because they have ONLY lost you maybe 12%… Pure insanity and ALL because we came off a GOLD Standard which held thse crooked Central Bankers to be honest and not the scam artists they are today.

I’m still stacking gold, but mostly silver now. Also lead bullets and plenty of other preps. Ya’ll don’t plan on coming up here in the holler, y’heah??