Emerging market currencies are collapsing pretty much everywhere these days. But it’s safe to assume that most people don’t understand exactly what’s causing this outbreak, why it’s happening now, or what “external dollar debt” has to do with it. So here’s a quick primer followed by the obligatory apocalyptic prediction:

Prelude: cheap dollar financing

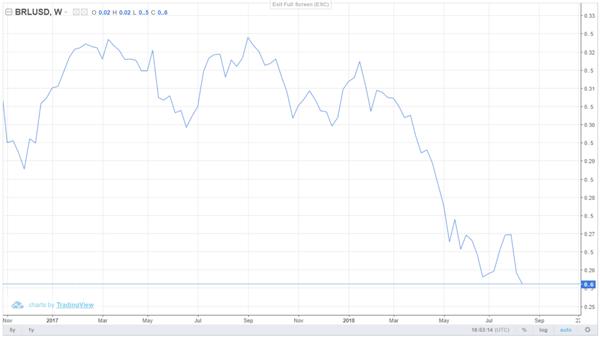

Pretend for a second that you’re Brazil. Your economy is in pretty good shape and your currency – the real – is getting stronger. Because of this, people are willing to lend you money.

Your internal interest rates – that is, what you’d have to pay to borrow real – are around 6%.

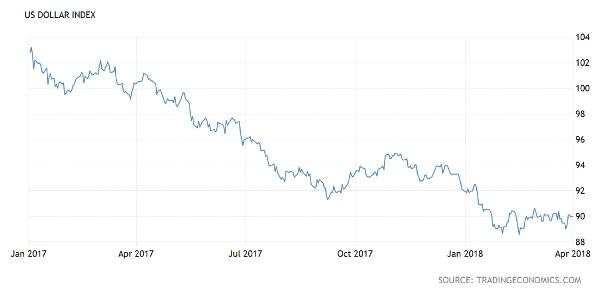

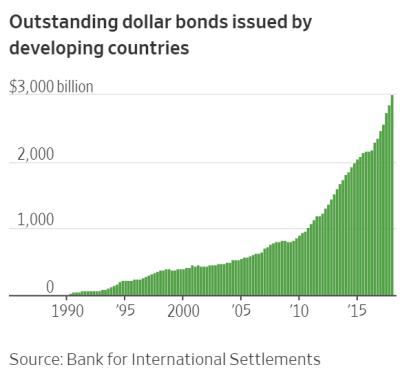

But when you look overseas you notice that US dollars – which have been trending down for a while – can be borrowed for around 2%. So you run some numbers and conclude that if you borrow dollars and assume that the real continues to rise against the dollar, you’ll make out two ways, on the spread between what you pay for those dollars and what you earn by investing them, and when you pay back the loans with depreciated dollars. So you borrow dollars, not just a little but a lot because with a lot you make a fortune.

So far so good. For a while the dollar keeps falling versus the real and you earn a nice spread. You feel smart, like you’ve figured out international finance and henceforth will will have a seat at the big table.

The turn

But then the unexpected (for you at least) happens. The dollar stops falling and starts rising.

And suddenly the spread you’re making on your external dollar debt no longer offsets the cost of paying back those ever-more-expensive dollars. That’s bad but manageable as long as the trend (dollar rising versus the real) doesn’t get too extreme. But the financial markets don’t like what they’re seeing and traders start selling real, forcing its value down further. Now you’re looking at massively negative cash flow and a possible death spiral as the markets sell your currency, which makes your dollar loans even more unmanageable and so on, with no end in sight.

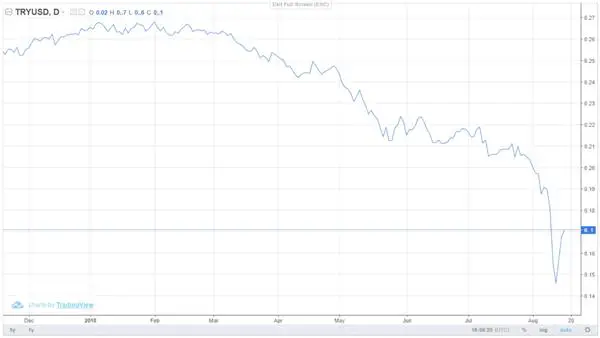

Your only consolation at this point is that other countries have made the same mistake on an even bigger scale. Turkey, for instance, has a much higher external dollar debt relative to GDP than you do, and is therefore reaping a bigger whirlwind. See Talking Turkey: ‘This Will Be The Single Largest Default In Financial History’.

But this is not really that comforting because in a suddenly-spooked world, a problem in one developing country sends the markets into a frenzy of “who’s next???” speculation, which which produces a very long list that, alas, includes you. So Turkey’s chart is a potential glimpse of your future.

Systemic Issues

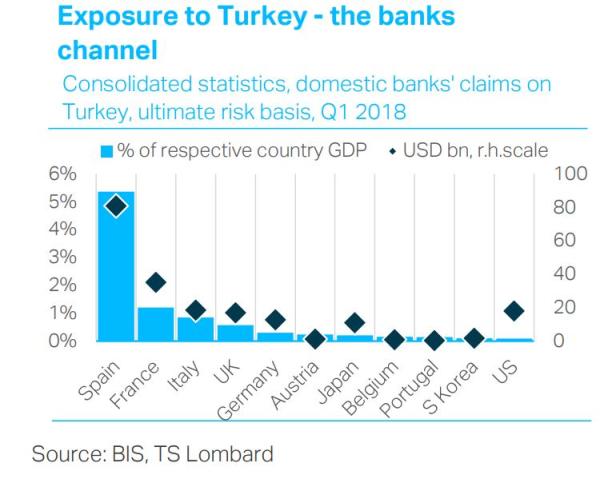

So far the story has been about the problems of emerging markets which, while interesting and maybe disturbing, aren’t really a big deal for fat and happy Europeans or Americans. But this is the age of globalization when everything is interconnected. Which is a fancy way of saying that someone lent all those dollars to Turkey et al, and is therefore on the hook for whatever isn’t repaid. Busted emerging market currencies are now everyone’s problem. Here’s the bank exposure data for Turkey:

Note that Spanish banks for some reason really, really liked Turkey back in the day, and are now on the hook for an astounding 5% of Spanish GDP. For other developing countries the exposure varies among banks and nations, but in the aggregate the risk reaches well into “systemic” territory. That is, if allowed to default, the emerging markets could take down some major developed world banks and threaten the fiat currencies of those countries. Now it’s serious.

History rhymes

We’ve been here before, of course. Emerging markets seem to implode about once a decade, and each and every time since Alan Greenspan’s tenure as Fed chair in the 1990s, the developed world’s governments and central banks have responded exactly as they should in a capitalist system, allowing the offending banks to fail, thus sending the message that risky behavior carries a downside as well as an upside.

Just kidding. They bailed out everyone in sight every time, convincing the major banks that no risk is too great in pursuit of outsized profits because once an institution achieves “too big to fail” status it has the government permanently at its back. And so here we are, with yet another set of systemically-threatening crises bubbling up and another round of massive bail-outs soon to follow.

4 thoughts on "Here’s How “External Dollar Debt” Produces An “Emerging Market Crisis”"

Thank you so much for simplifying the latest EM meltdown.

I kind of knew what was happening but not completely.

Now I get it!

Or will they be Bail-ins this time around?